¶ HOW TO CHANGE VAT DETAILS

Watch on YouTube > https://youtu.be/93cgvysMesU

- Sales Tax

- Purchase Tax

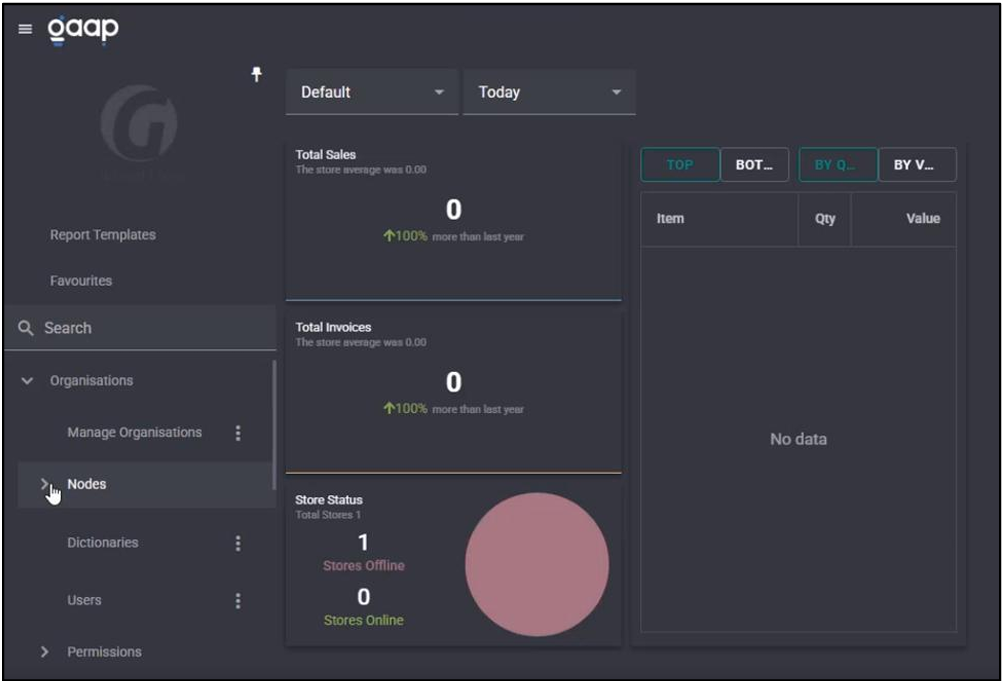

On the Dashboard, select Organisations. - From the dropdown options, select Node

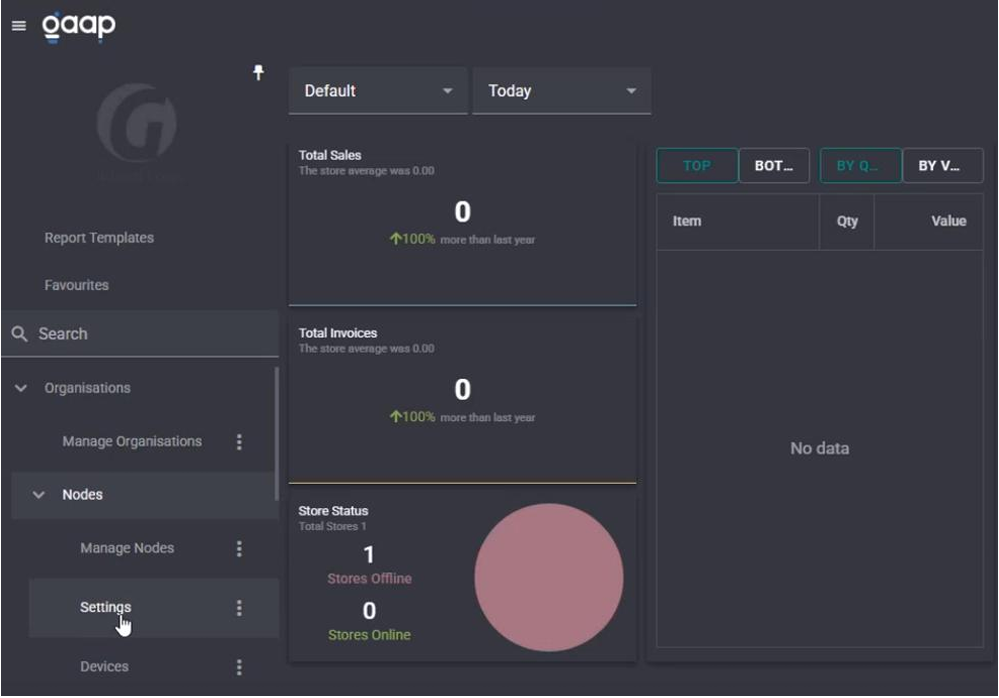

- Select Settings.

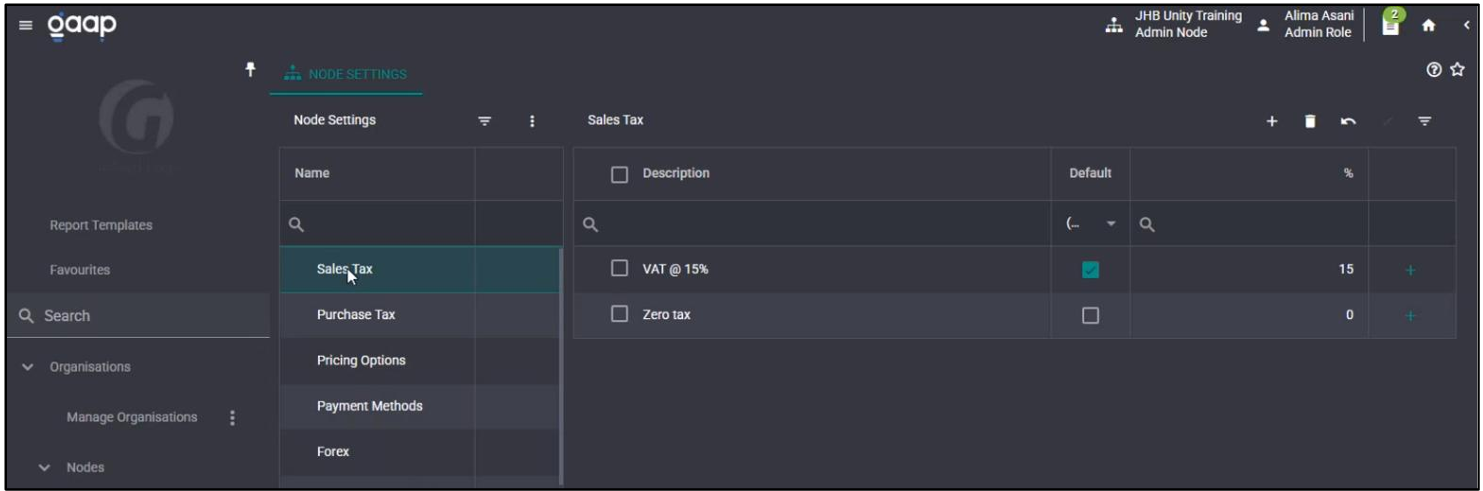

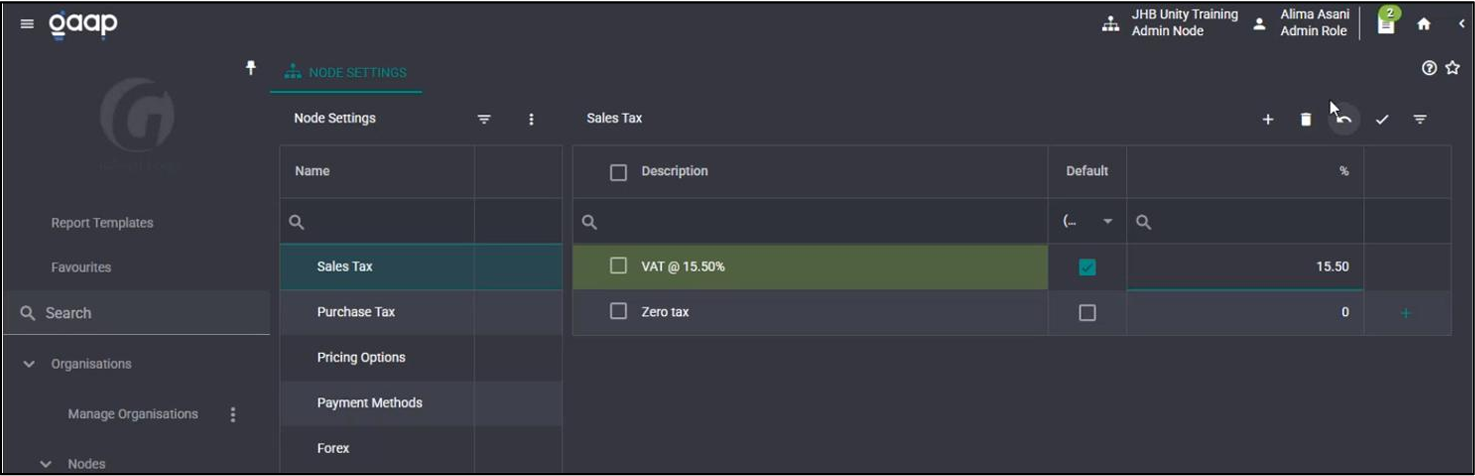

Sales Tax

- Select Sales Tax.

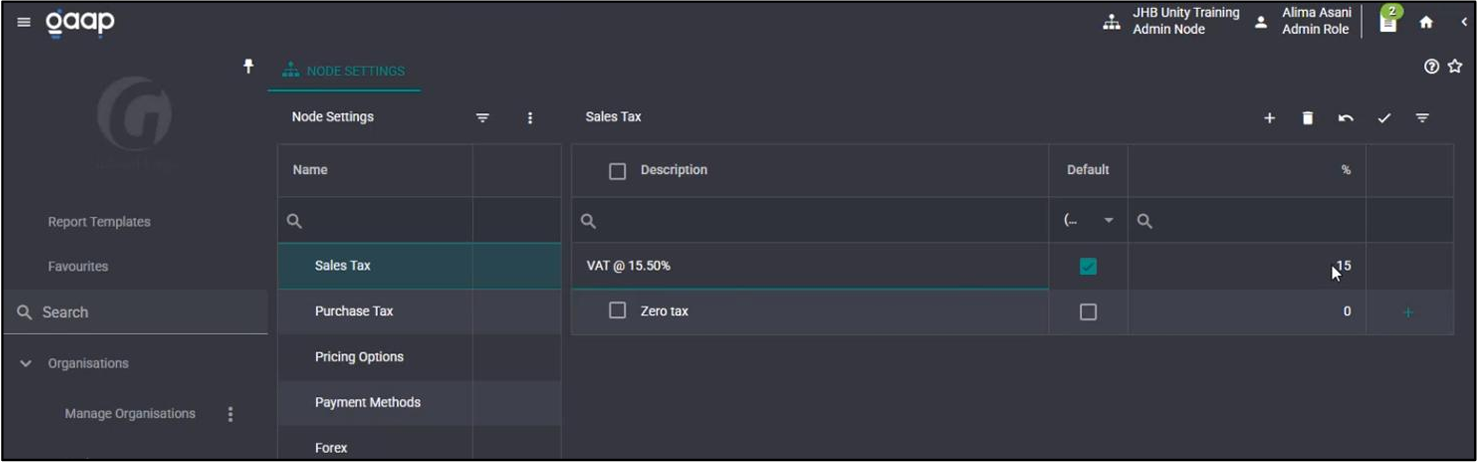

- Under the Description column, click on your VAT and change it to the new VAT percentage.

- For example, VAT from 15% change to 15.50%.

- Under the % column, click on your VAT and change it to the new VAT percentage.

- For example, VAT from 15% change to 15.50%.

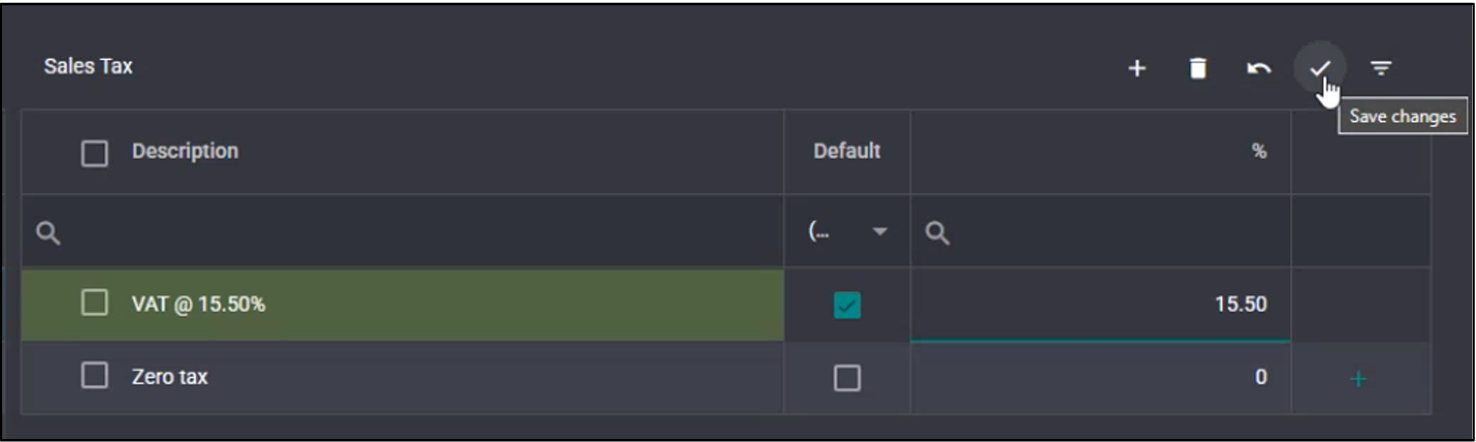

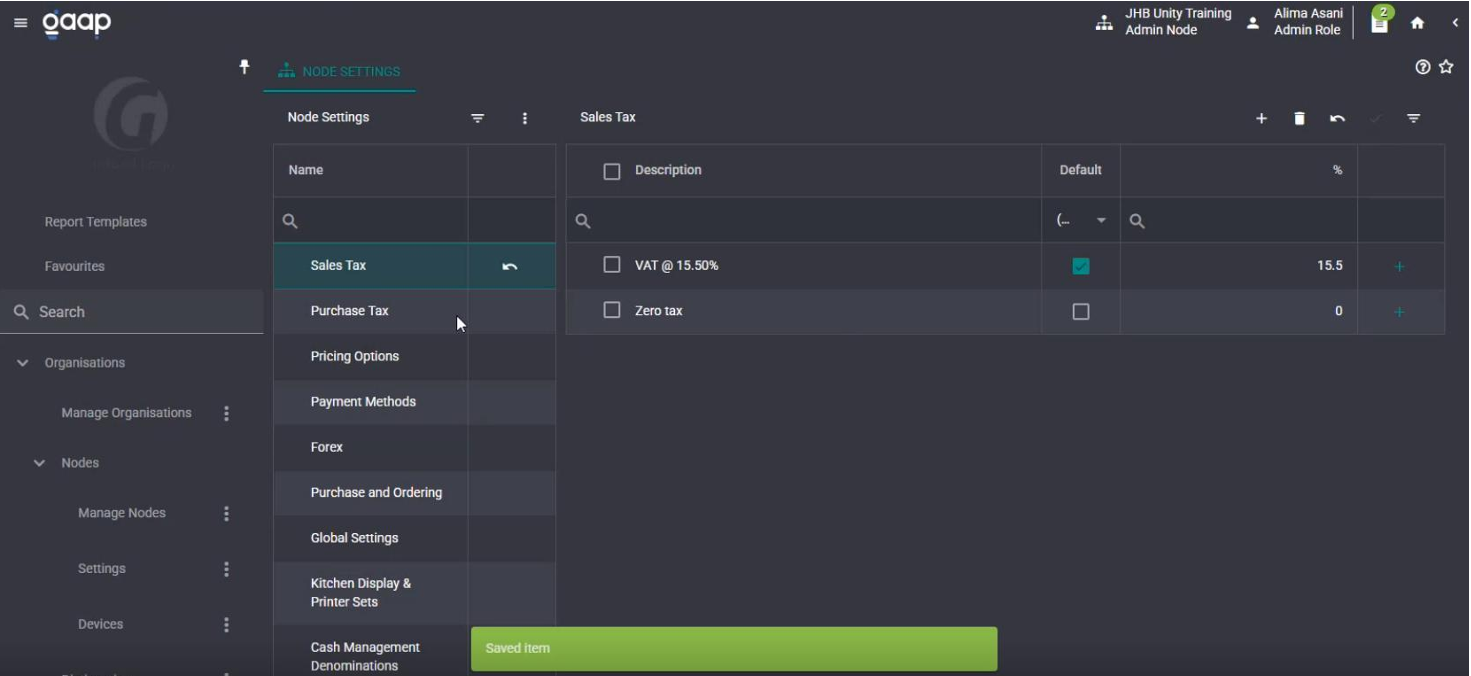

- Select the tick Icon to Save.

- The green Save bar will appear at the bottom of the screen. Your new VAT % has been saved.

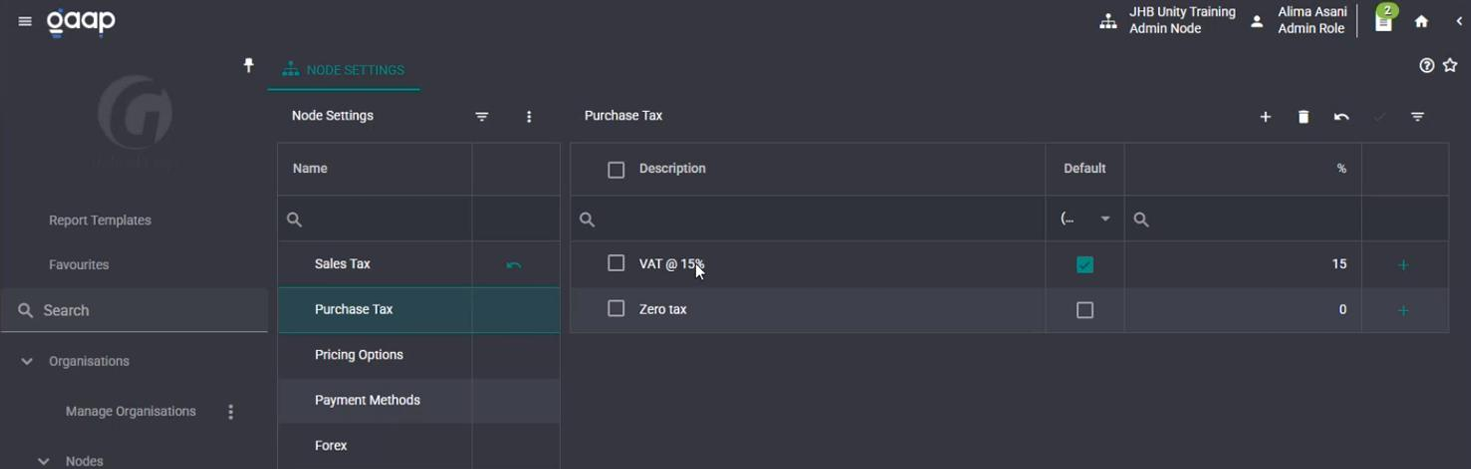

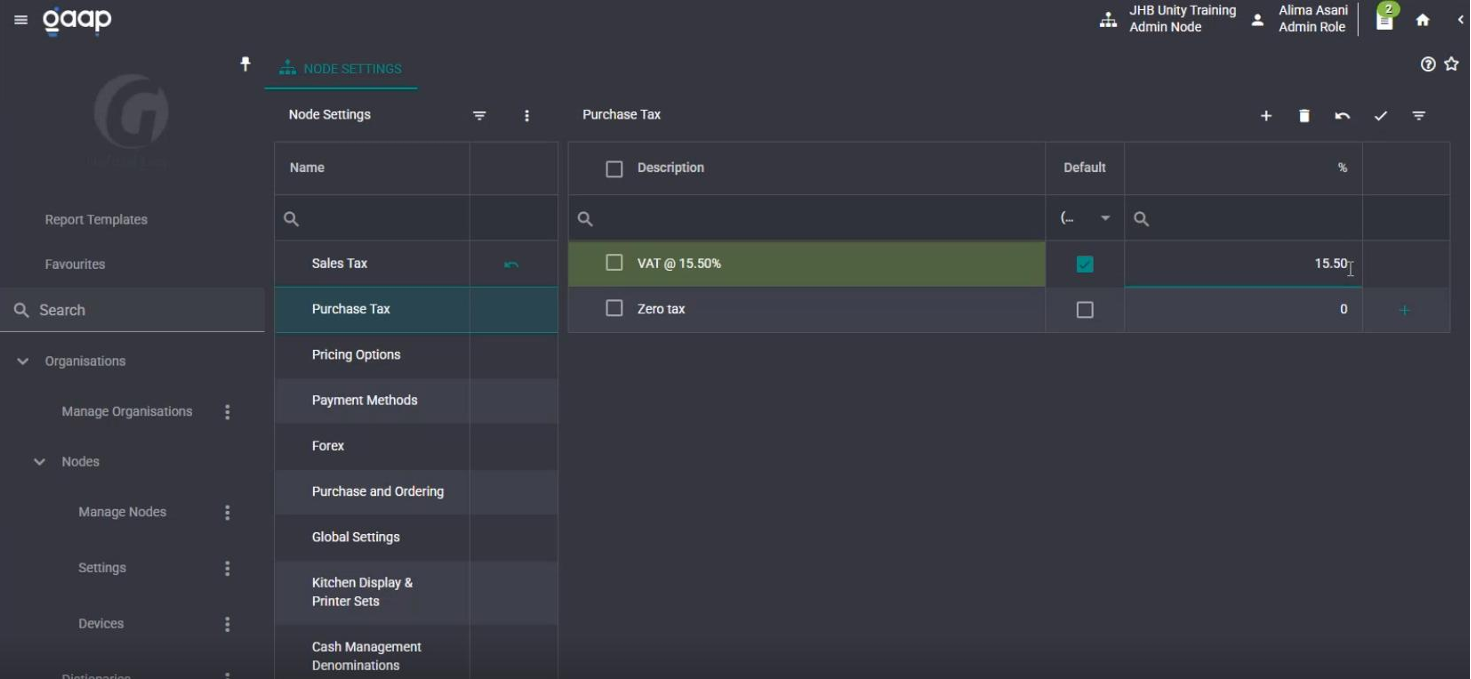

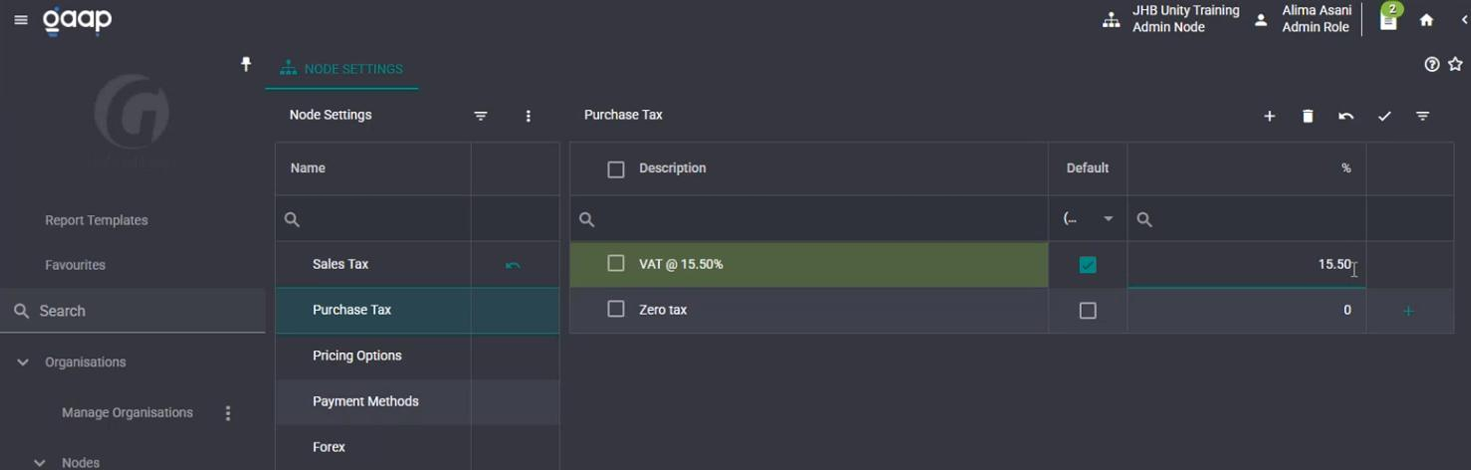

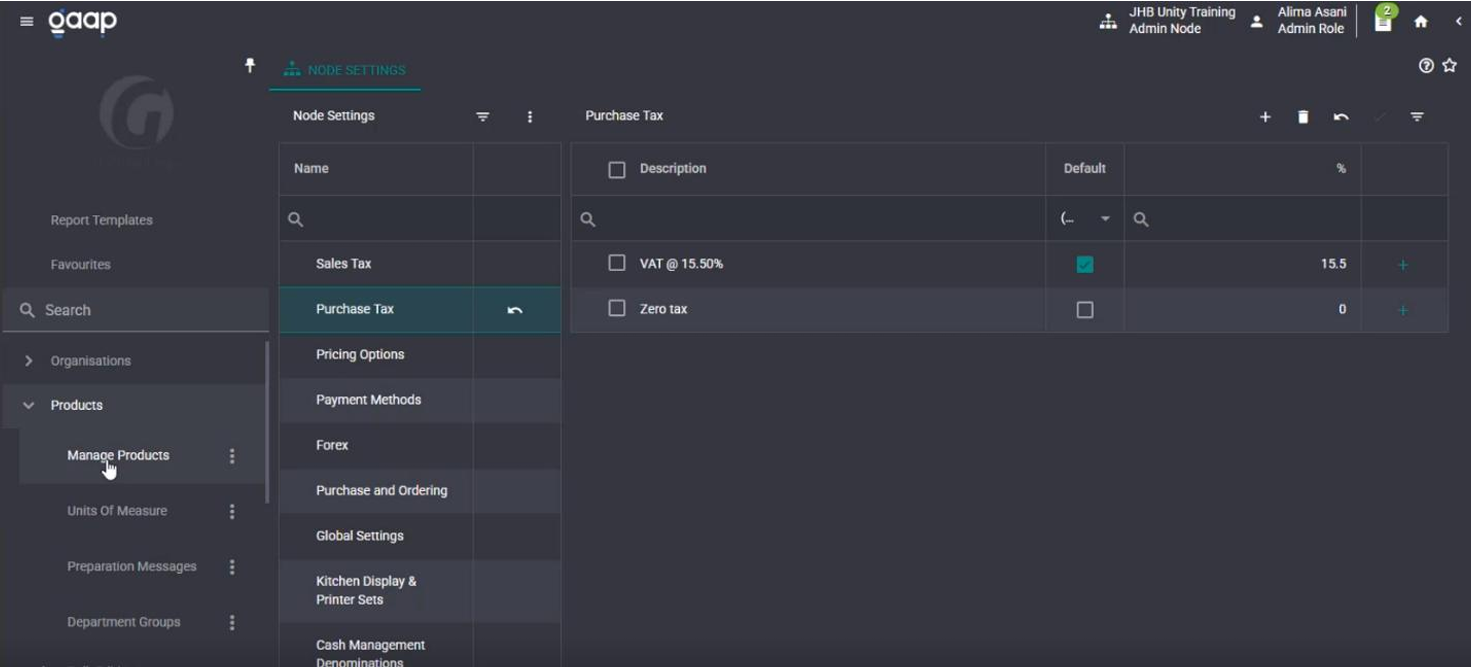

Purchase Tax

- Select Purchase Tax.

- Under the Description column, click on your VAT and change it to the new VAT percentage.

- For example, VAT from 15% change to 15.50%.

- Under the % column, click on your VAT and change it to the new VAT percentage.

- For example, VAT from 15% change to 15.50%

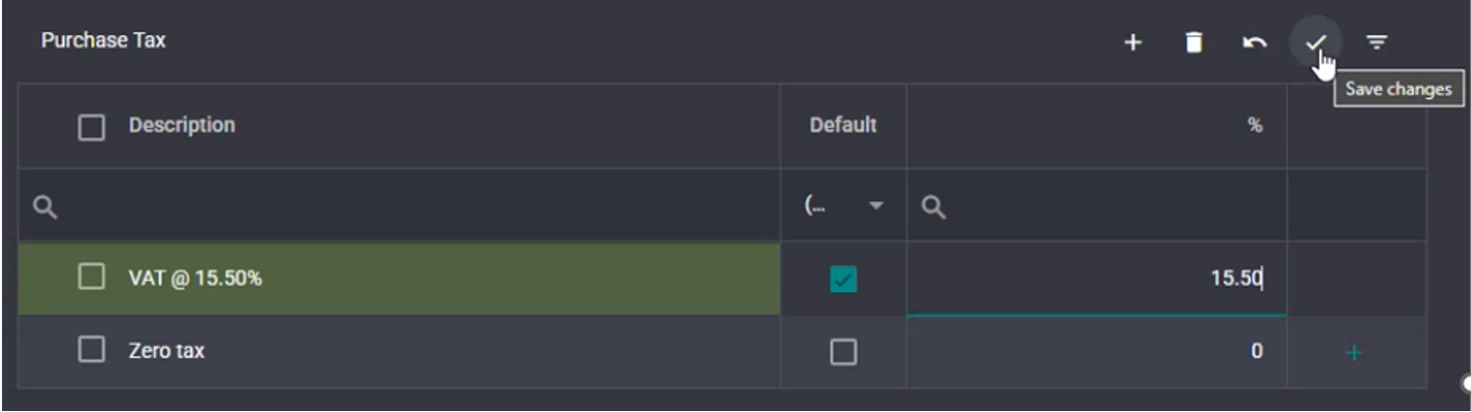

- Select the tick Icon to Save.

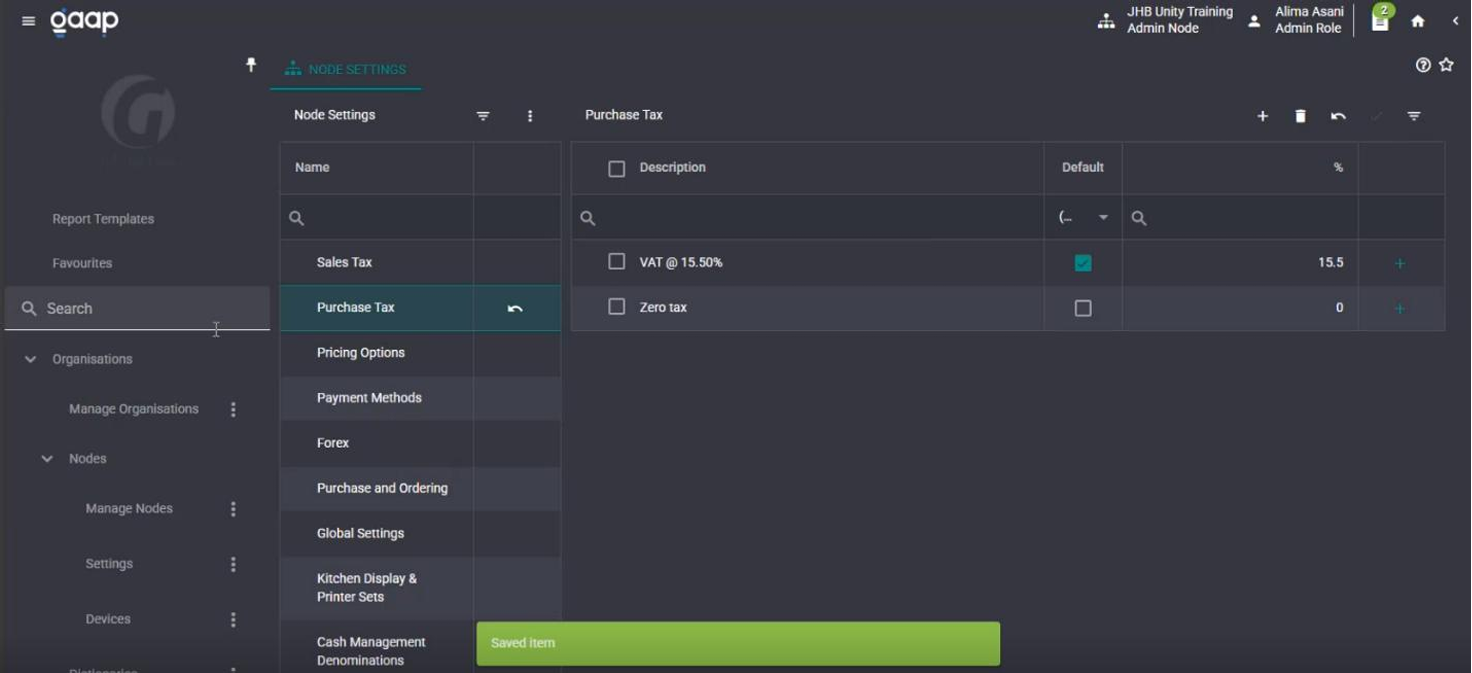

- The green Save bar will appear at the bottom of the screen. Your new VAT % has been

saved.

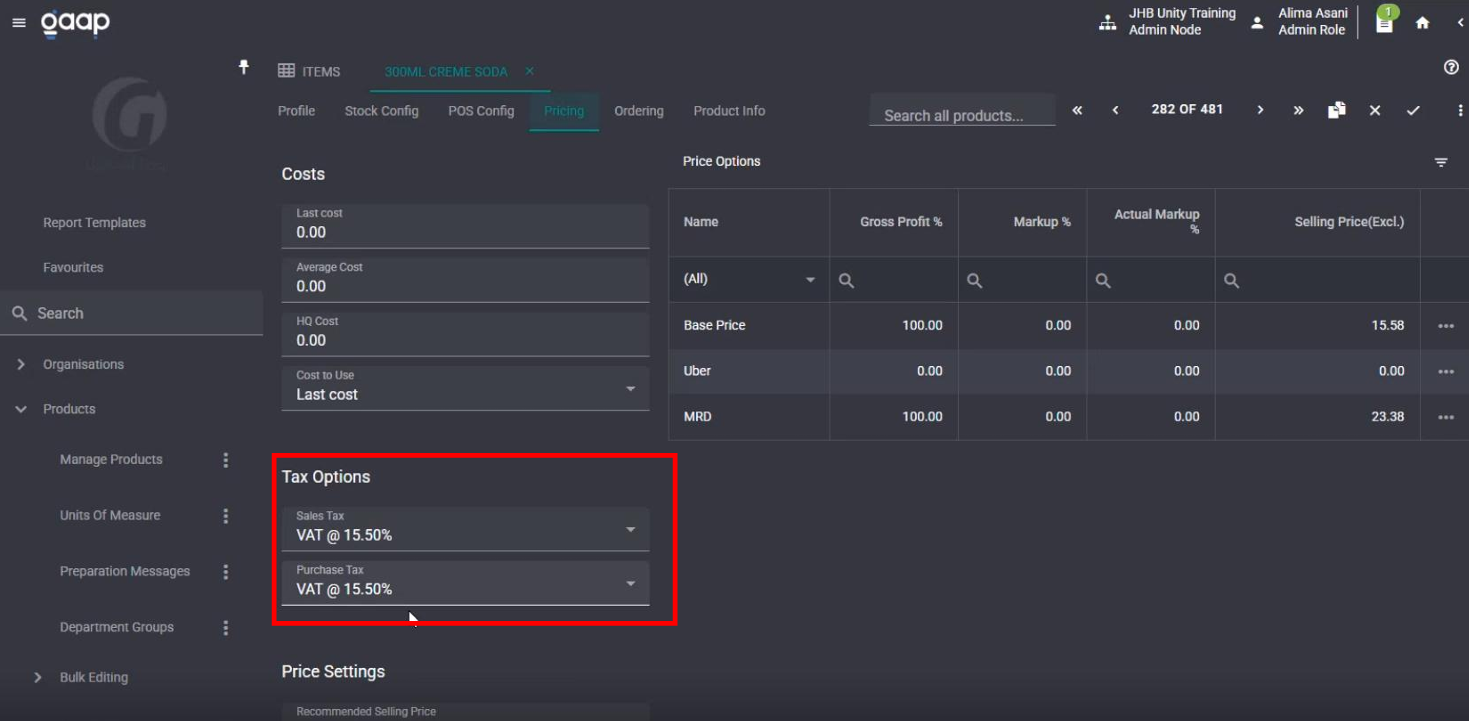

To ensure the VAT has been adjusted, select Products.

- Select Manage Products.

- Select the Pricing tab.

- Under Tax Options you will see the new VAT% reflected.

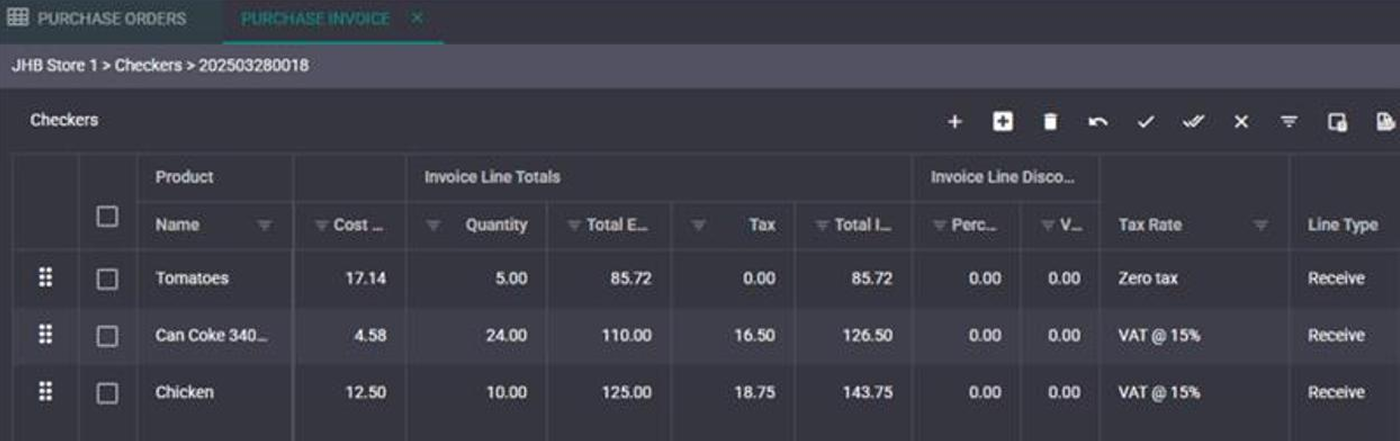

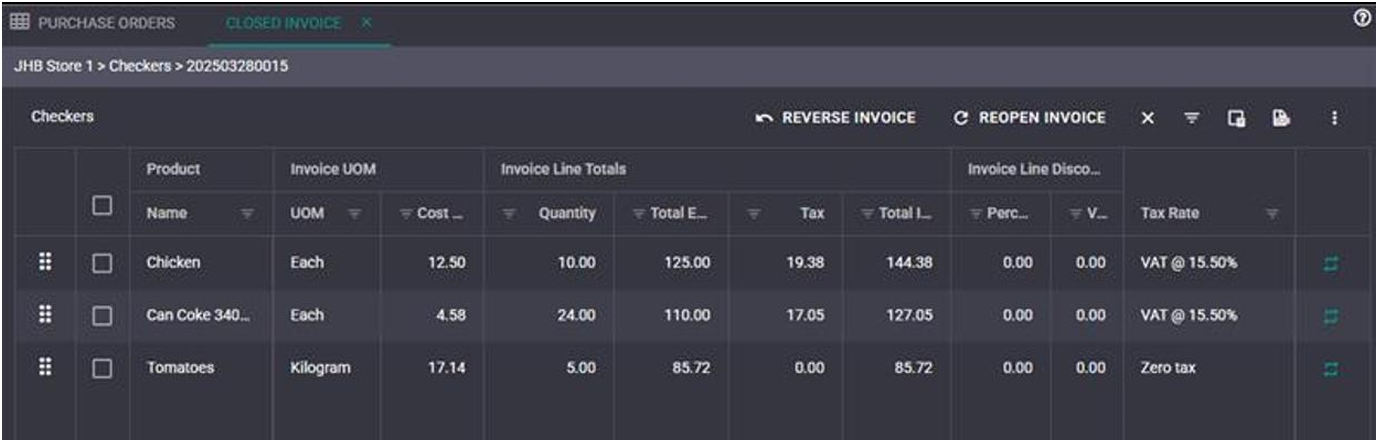

Procedure for adjusting a Purchase Invoice if it contains an incorrect, previous VAT value.

• Change the Purchases VAT rate in the Settings to 15%.

• Create and complete the Purchase Invoice.

• Verify the accuracy of the Purchase Invoice.

• Return the Purchases VAT rate in the Settings to 15.5%.

Or,

• Go to the Purchase Invoice tab.

• Notice it shows a previous VAT rate.

• Change the TAX Rate in the column from 15% to 15.50%

• Check the reports for that period and that it shows 15.5 percent.